20 SOUTH BROAD STREET

CANFIELD, OHIO 44406

March [18], 201912, 2021

To Our Shareholders:

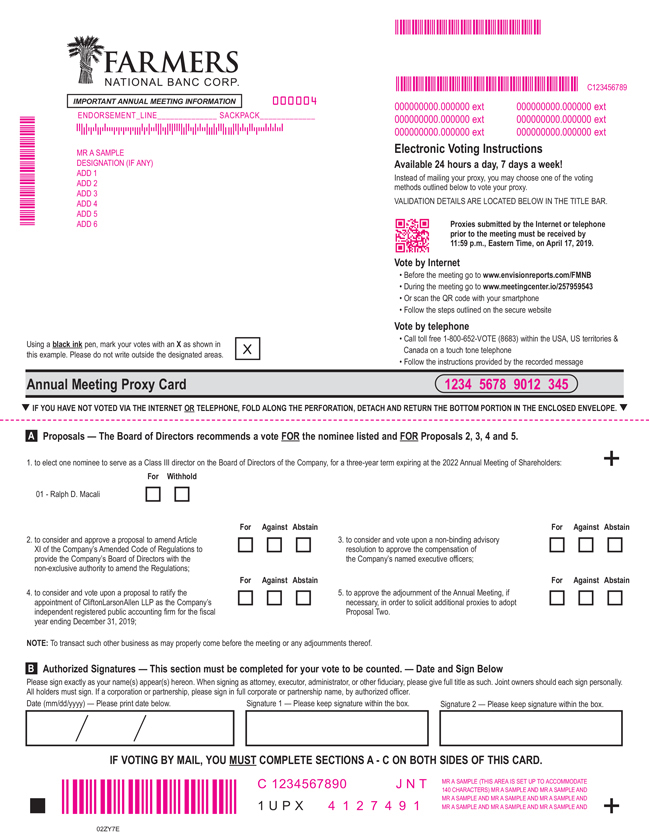

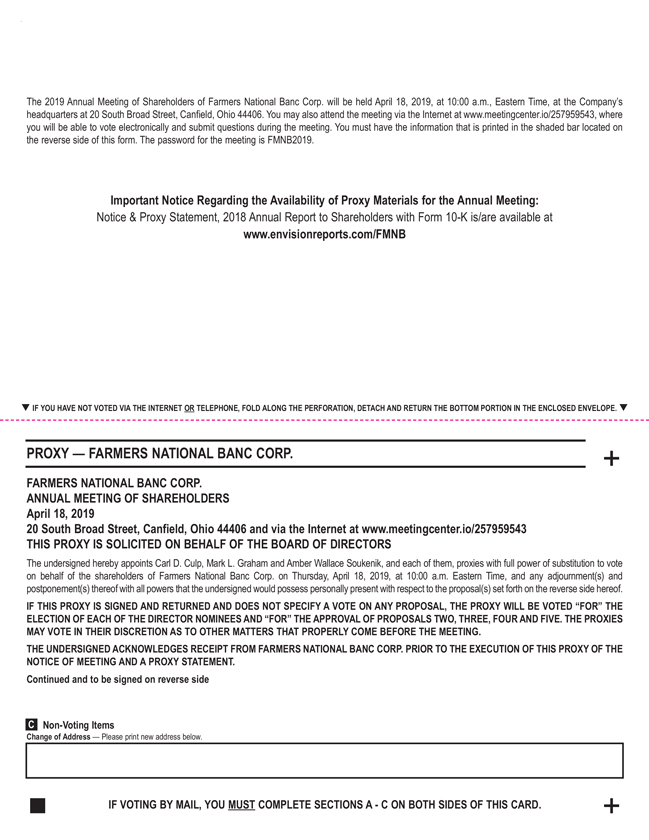

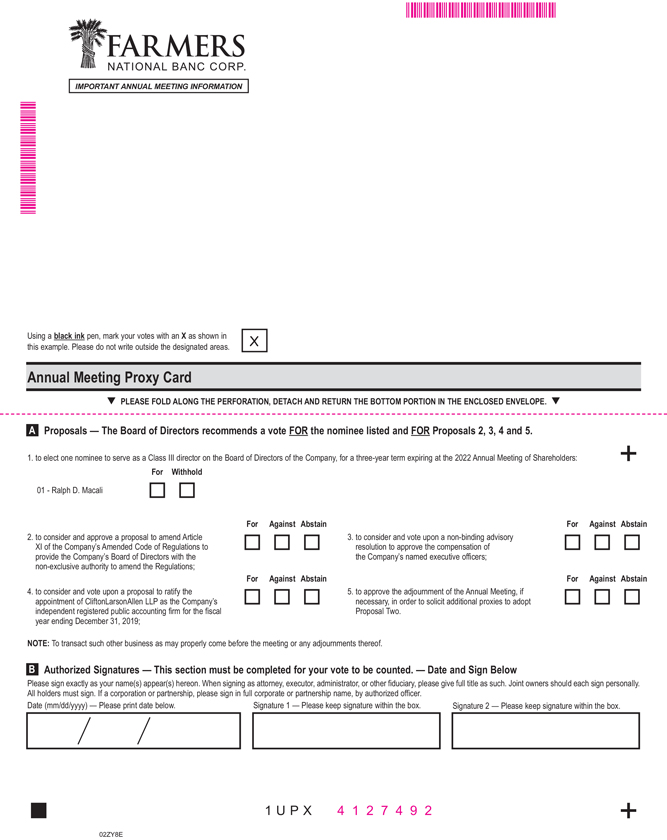

You are cordially invited to attend the 20192021 Annual Meeting of Shareholders of Farmers National Banc Corp. (“Farmers” or the “Company”) to be held on April 18, 2019,15, 2021 at 10:00 a.m., Eastern Time,Time. We have adopted a virtual format for our Annual Meeting to provide a consistent experience to all shareholders regardless of location. We will provide a live webcast of the Annual Meeting at the Company’s headquarters at 20 South Broad Street, Canfield, Ohio 44406. You may also attend the meeting via the Internet atwww.meetingcenter.io/257959543240338918, where you will be able to vote electronically and submit questions during the meeting.

AtDuring the Annual Meeting, you will be asked to: (i) elect onethree Class III directorII directors whose termterms will expire at the Annual Meeting in 2022;2024; (ii) approve an amendment to the Company’s Amended Code of Regulations (“Regulations”) to provide the Company’s Board of Directors with thenon-exclusive authority to amend the Regulations; (iii) consider and vote upon anon-binding advisory resolution to approve the compensation of the Company’s named executive officers; (iv)and (iii) ratify the Audit Committee’s appointment of CliftonLarsonAllen LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; and (v) approve the adjournment of the Annual Meeting, if necessary, in order to solicit additional proxies to adopt the proposed amendment to the Company’s Regulations.2021.

Your vote on these matters is important, regardless of the number of shares you own, and all shareholders are encouraged to attendparticipate in the live webcast of the Annual Meeting via the Internet or in person.Meeting. However, it is important that your shares be represented regardless of how or whether you plan to attendparticipate in the live webcast of the Annual Meeting. In order to ensure that your shares are represented, I urge you to execute and return the enclosed proxy, or that you submit your proxy by telephone or Internet promptly. I particularly encourage your support of Proposal Two and the recommendation of our Board of Directors to amend our Regulations to give our Board of Directors thenon-exclusive authority to amend our Regulations as permitted under Ohio law. A further description of Proposal Two can be found on page 21 of the accompanying proxy statement.

Sincerely,

KEVIN J. HELMICK

President and Chief Executive Officer